The Nasdaq is up 11% so far in January, putting it on track for its best monthly performance since July.

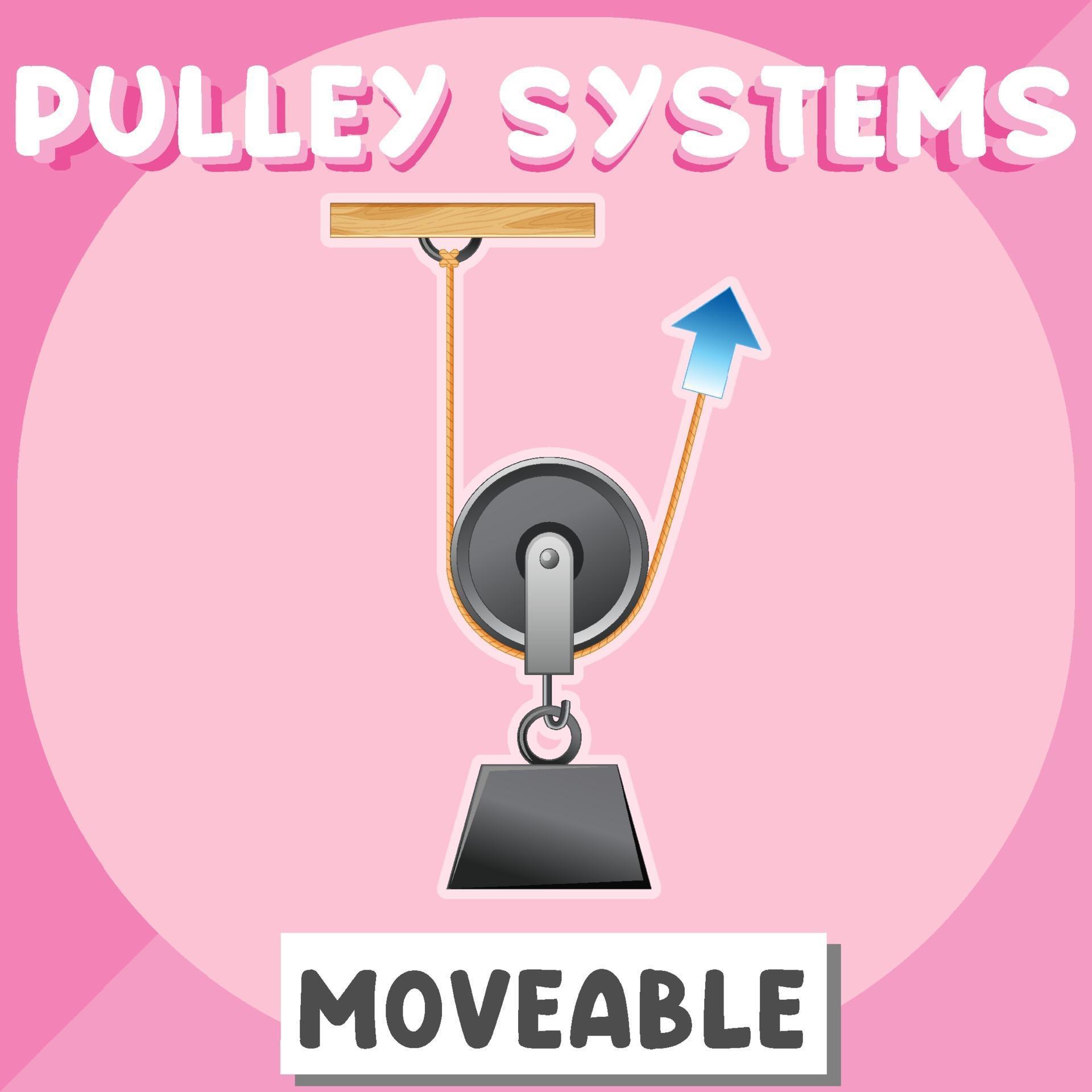

#Movable aerial platform clue series

Just look at how well tech stocks have done so far this year, despite a series of high-profile layoff announcements from top Silicon Valley companies in the past few months. Wall Street is clearly buying into the “soft landing” argument. That increases the chances the Fed could go too far with rate hikes and ultimately lead to a recession. So as long as hopes for an economic “soft landing” persist, the Fed will have to keep worrying that inflation is too high. “Combine a strong labor market with a still substantial reserve of excess savings, and you have all the components in place to keep the Fed up at night,” Vaillancourt said. That could mean that inflation isn’t going away anytime soon.Īnd even though the pace of jobs gains may be slowing, it’s not as if economists are starting to predict monthly job losses like the US has had in previous recessions. Vaillancourt also pointed out that many consumers are still flush with cash that they saved up during the early stages of the pandemic. “Workers will be loath to relinquish the bargaining power they perceive to have gained over the past year,” said Jason Vaillancourt, global macro strategist at Putnam, in a report. And more workers at tech and retail giants have been unionizing as of late. Organized labor has been winning bigger pay increases lately in the transportation industry. Not everyone agrees with that assessment. Joe Raedle/Getty Imagesīad omen for drivers: It's only January, but gas prices are already surging Gas is pumped into a vehicle at a gas station on Januin Miami, Florida. “Wage growth has been on a slowing trajectory, and we suspect that softer wage growth will be a trend in 2023 as jobs available contract,” said Tony Welch, chief investment officer at SignatureFD, a wealth management firm, in a report. Still, some expect that wage growth should continue to fall, which should take pressure off the Fed somewhat.

The last JOLTS report showed that more jobs were available than expected in November.

The market will also be closely watching reports about private-sector job growth from payroll processor ADP and the Job Openings and Labor Turnover Survey (JOLTS) from the Department of Labor this week. Investors will get the latest weekly initial claims numbers on Thursday. The number of people filing for weekly jobless claims dipped last week to 186,000, a nine-month low. Several other job market indicators continue to show that the US economy is in no serious danger of a recession just yet. The problem for the Fed, though, is that it may need to keep raising interest rates until there is further evidence that the labor market is cooling off enough to push the rate of inflation even lower. That is still uncomfortably high, but the trend is moving in the right direction. The Fed’s favorite measure of inflation – the Personal Consumption Price Index or PCE – rose “just” 5% over the past 12 months through last December, compared to a 5.5% annual increase in November. That’s down from 4.6% in December and 5.1% in November.Īs wage growth cools, so do price increases. Inflation could get a second windĪlong those lines, average hourly earnings, a measure of wages that is also part of the monthly jobs report, are expected to increase 4.3% year-over year. Wang Jianwei/Xinhua/Getty ImagesĬhina's reopening isn't all good news. in Harbin, capital of northeast China's Heilongjiang Province on November 22, 2022. An employee works in a workshop of the Northeast Light Alloy Co., Ltd.

0 kommentar(er)

0 kommentar(er)